Business Insurance in and around Santa Fe

Looking for coverage for your business? Look no further than State Farm agent Michelle Cole!

This small business insurance is not risky

This Coverage Is Worth It.

Do you own a hearing aid store, a clock shop or a barber shop? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on making this adventure a success.

Looking for coverage for your business? Look no further than State Farm agent Michelle Cole!

This small business insurance is not risky

Insurance Designed For Small Business

Your business thrives off your tenacity passion, and having reliable coverage with State Farm. While you do what you love and put in the work, let State Farm do their part in supporting you with business owners policies, commercial liability umbrella policies and worker’s compensation.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Michelle Cole's team to discover the options specifically available to you!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

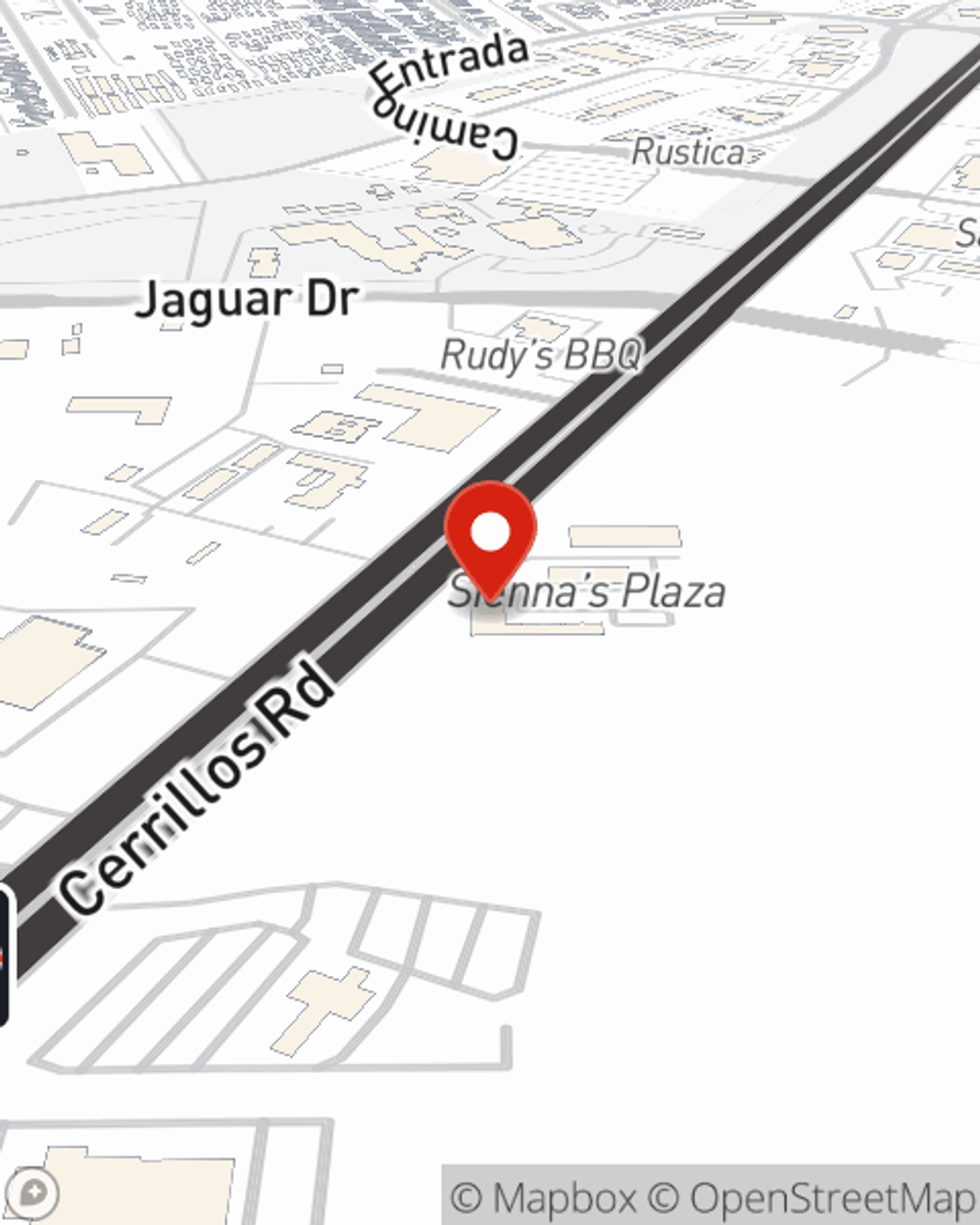

Michelle Cole

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.